A 29-year-old former ballerina from Brazil, Luana Lopes Lara, has become the world’s youngest self-made female billionaire after her prediction-markets company Kalshi secured a $1 billion funding round valuing the business at $11 billion, according to published reports and the company’s own announcement. The deal has pushed Lopes Lara’s estimated net worth to about $1.3 billion and moved her past singer Taylor Swift, who had been widely cited as holding the “youngest self-made female billionaire” label after reaching billionaire status largely on the back of the global success of her Eras Tour.

Kalshi, based in New York, said on 2 December that its Series E round was led by Paradigm, with participation from Sequoia, Andreessen Horowitz, Meritech Capital, IVP, ARK Invest, Anthos Capital, CapitalG and Y Combinator, among others. The company described the raise as $1 billion at an $11 billion valuation, placing Kalshi among the most highly valued firms in an industry that has expanded rapidly as prediction markets moved from niche corners of finance and political science into mainstream consumer products.

The funding and valuation are central to the billionaire calculations around Kalshi’s founders, because their wealth is tied to their equity stakes in the company. Reports including People and The Independent, citing Forbes, said Lopes Lara and her co-founder, Tarek Mansour, each own roughly 12% of Kalshi, a stake that at the new valuation would be worth about $1.3 billion.

Lopes Lara’s personal story has helped draw attention far beyond finance. People reported that she trained as a ballerina at the Bolshoi Theatre School in Brazil before leaving the dance world and later enrolling at the Massachusetts Institute of Technology to study computer science, where she met Mansour. The same reporting said she performed professionally for nine months in Austria before shifting her focus toward technology and markets, and that her early life was defined by intense discipline and competitive pressure in the ballet world.

Kalshi’s business centres on “event contracts,” which allow users to buy and sell positions tied to the probability of real-world outcomes, from elections and economic indicators to sports and pop culture. The growth of these markets has been fuelled by consumer appetite for trading-like betting products, as well as the argument advanced by companies such as Kalshi that, when structured as derivatives contracts and overseen by federal regulators, they fall under a different regulatory framework than traditional gambling.

That claim has been tested repeatedly in court and in state enforcement actions. A Reuters report on Kalshi’s latest financing noted that the company had raised $300 million at a $5 billion valuation less than two months earlier, underscoring how quickly investor enthusiasm has accelerated. In the same report, PitchBook analyst Rudy Yang was quoted as saying, “Event contracts may be seen as speculative, but the explosive growth of Kalshi and Polymarket indicates they are more than just betting mediums.”

Kalshi’s rise has also unfolded alongside escalating scrutiny over where prediction markets end and gambling begins, particularly as the industry pushes into sports. In late November, a federal judge in Nevada ruled that Kalshi must comply with Nevada gaming rules as it seeks to offer sports-related products, rejecting the company’s argument that it is regulated solely as a federally overseen exchange under the Commodity Exchange Act. Reuters reported the judge said Kalshi’s position misconstrued federal law and would undermine state and tribal authority over gaming, and that Kalshi was appealing.

The company has maintained that it operates under federal oversight and that its products are subject to integrity monitoring and customer checks. Separately, industry tension around sports-related contracts has widened into public disputes. The New York Post reported this month that the NCAA criticised Kalshi over potential contracts linked to the college transfer portal, with NCAA President Charlie Baker condemning the idea and warning it could increase pressure on student-athletes. Kalshi, the Post reported, said it operates under “strict federal oversight” with integrity and KYC systems.

Long before the latest sports-related battles, Kalshi’s defining regulatory fight involved political markets. In 2024, Kalshi challenged the Commodity Futures Trading Commission after the agency blocked the exchange from listing contracts tied to the outcome of congressional control in the November 2024 elections. A published federal appellate opinion describes the dispute as centred on whether such contracts amounted to “gaming or election gambling,” which the Commission said was prohibited, and whether the CFTC exceeded its authority in blocking the contracts. The case has been closely watched as a bellwether for how far regulated event markets can go in the United States.

Those legal fights form part of the narrative that investors and supporters cite when describing Kalshi as a company that took unusually high regulatory risk for a potential breakthrough market. People, citing Forbes, reported that the founders approached dozens of law firms early on and were turned away repeatedly, and quoted Lopes Lara describing the stakes: “Right out of college, we were taking on an insane amount of risk. It was two years without a single product,” she said, adding that without regulatory approval “the company would just go to zero.”

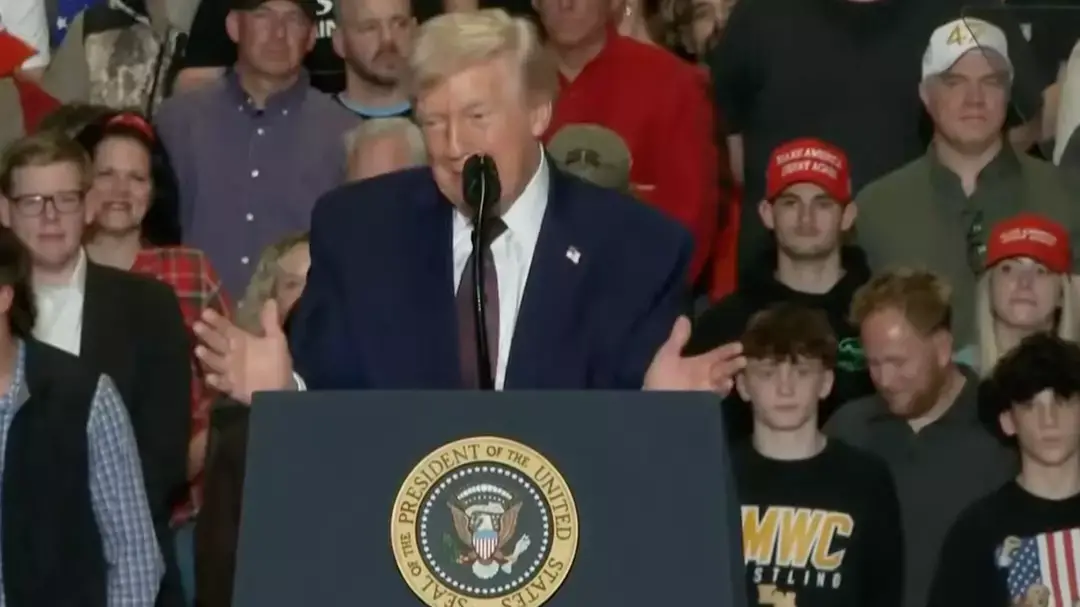

As Kalshi expanded, it also sought high-profile connections that could help it navigate both public attention and policymaking. In January 2025, Kalshi announced that Donald Trump Jr. was joining as a strategic adviser, calling it a milestone in its effort to bring prediction markets into the mainstream. Axios also reported the appointment, describing it as an adviser role tied to the company’s growing profile amid ongoing regulatory debates.

The broader prediction-markets boom has created a fast-moving leaderboard for young wealth, especially for founders whose net worth depends on venture valuations rather than public-market prices or cash distributions. In April 2025, LADbible reported on a separate shift in the “youngest self-made woman billionaire” label involving Lucy Guo of Scale AI, reflecting how the title has become a rolling headline driven by changes in estimated worth and valuations. By December, coverage including People said Lopes Lara had overtaken both Guo and Swift following Kalshi’s funding round.

Swift’s wealth, by contrast, has been tied to the commercial success of her music catalogue and touring. People’s report pointed to the Eras Tour as the major driver of her billionaire status, and noted that she had been surpassed amid the new round of paper wealth created by private-market valuations in technology and finance.

For Lopes Lara, the sudden jump from founder to billionaire has come with heightened public interest in a life that until recently was largely outside celebrity media. Profiles published this month have emphasised the unusual arc from elite ballet training to MIT and then to building a company at the intersection of finance, technology and regulation. MoneyWeek described Kalshi’s valuation as having surged after years of relatively modest fundraising, noting that outside investors had piled in as prediction markets grew in popularity and scale.

The next phase for both Lopes Lara and Kalshi may be determined less by venture capital appetite than by the durability of the company’s regulatory footing, especially as states and sports bodies challenge event contracts that resemble betting. At the same time, the industry’s trajectory suggests competition will intensify as large financial and technology platforms look for ways to offer prediction-style products to mass audiences, and as rivals such as Polymarket draw their own major capital and partnerships. With Kalshi now valued at $11 billion and its founders newly minted billionaires on paper, the company’s ability to defend its model in courts and regulators’ offices is likely to shape whether this moment becomes a lasting shift in American markets or a brief surge defined by a hot sector and an even hotter headline.