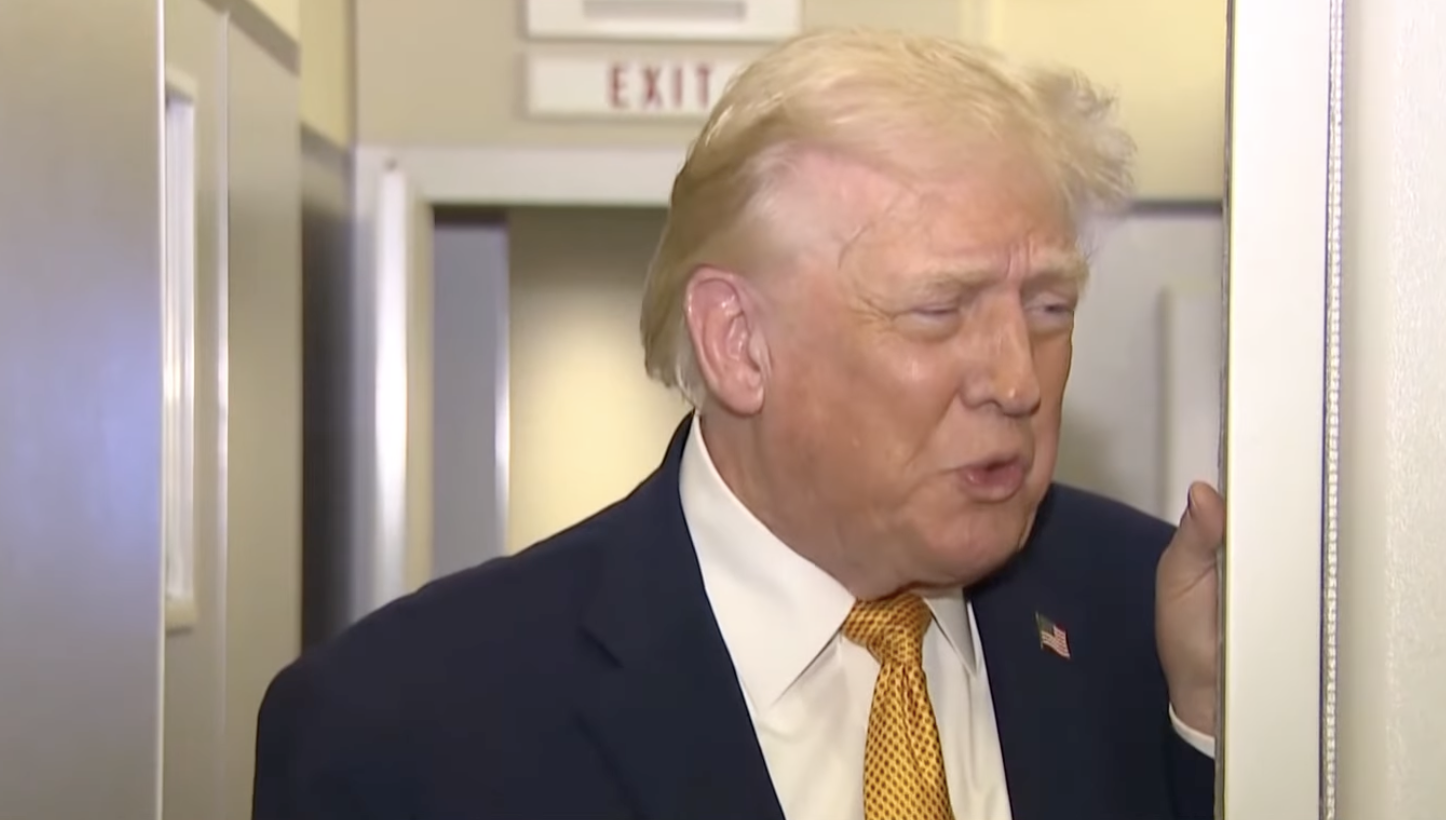

President Donald Trump has warned the United States would be “screwed” if the Supreme Court rules against his administration in a closely watched legal fight over sweeping “reciprocal” tariffs imposed under emergency powers, arguing an adverse decision could force the federal government to refund vast sums and weaken the country’s leverage in trade disputes.

“We’re screwed!” Trump wrote on Truth Social in a post that also claimed, “Our nation is going to lose trillions of dollars, something never seen before. It will be the harshest financial ruling ever leveled against us as a sovereign nation.”

The Supreme Court case centres on whether the White House lawfully used the International Emergency Economic Powers Act, a 1977 statute known as IEEPA, to justify broad import duties that were framed as a response to national security and economic threats. The law gives presidents wide latitude to restrict certain transactions during a declared national emergency, but it has not traditionally been the tool used to levy across the board tariffs on imports from multiple countries.

The tariffs at issue were among the most expansive of Trump’s trade measures, distinct from other duties he has imposed using different legal authorities. The case has drawn intense attention from businesses, foreign governments and financial markets because of the potential impact on supply chains and prices, and because a loss could unravel a cornerstone of Trump’s economic agenda built around the threat and use of tariffs.

Lower courts have already ruled against the administration, finding Trump’s use of IEEPA to impose the duties exceeded the authority Congress granted in the statute. Those rulings set the stage for the Supreme Court to decide whether to uphold them, reverse them, or send the dispute back to a lower court for further proceedings.

The justices heard arguments in the case in November, and a decision is expected soon. Reporting in the United States has identified the matter as Learning Resources v. Trump, a challenge brought by a group that includes small businesses and importers affected by the duties.

The central stakes are not only whether the tariffs can continue, but what happens to revenue already collected at the border. If the Supreme Court strikes the tariffs down, the federal government could face a substantial bill for refunds to importers who paid the duties, with estimates in public reporting ranging from well over $100 billion to around $150 billion, depending on how the refund process is structured and how far back any repayment obligation reaches.

Treasury Secretary Scott Bessent has sought to play down the risks, saying the government has sufficient cash on hand to manage any repayments. “It won’t be a problem if we have to do it,” he said, referring to the prospect of refunds, while pointing to the scale of Treasury’s cash balance in recent comments reported in the US press.

Trump has argued that the numbers involved could be far larger when broader economic knock on effects are taken into account, contending that manufacturers might pull back investment decisions if the court removes his ability to use tariffs in future. He has framed the dispute as a matter of national leverage, warning that countries would have less incentive to negotiate if the US president cannot quickly impose duties on trading partners he views as acting unfairly.

In earlier posts on social media, Trump warned that losing the power to set such tariffs would be a “terrible blow” to the United States. In another statement cited in public reporting, he wrote: “Because of Tariffs, our Country is financially, AND FROM A NATIONAL SECURITY STANDPOINT, FAR STRONGER AND MORE RESPECTED THAN EVER BEFORE.”

The administration’s legal position has argued that the tariff programme is justified by emergency conditions and by the need to respond rapidly to what it describes as threats to the US economy and security. Challengers have countered that tariffs of this breadth are a major policy tool that the Constitution reserves to Congress, and that IEEPA does not clearly authorise a president to raise revenue and reshape trade policy in this way without explicit legislation.

The legal dispute also highlights how Trump has tried to consolidate trade powers in the White House, making tariffs central to his approach to domestic manufacturing, budget policy and foreign relations. Trump has repeatedly described tariffs as a way to pressure companies to build in the United States, to extract concessions from foreign governments, and to generate revenue. Critics say tariffs function as taxes on imports that can raise costs for US businesses and consumers, even when the political focus is on foreign exporters.

The Supreme Court’s decision could also shape how future presidents use emergency powers. IEEPA is most commonly associated with sanctions and restrictions targeting specific countries, companies or financial transactions. While it grants broad authority during emergencies, the question in this case is whether that authority extends to sweeping import duties that apply across a wide range of products and countries.

Any ruling is likely to prompt further legal and political manoeuvring. Trump has signalled that if the court blocks the tariffs, he will look for alternative legal pathways to maintain pressure on trading partners, suggesting that the administration could pursue other statutory authorities to impose duties, or seek legislative changes from Congress.

However, those routes can be slower or narrower in scope. Other tariff tools, such as the Trade Act of 1974, Section 232 of the Trade Expansion Act of 1962, or Section 301 actions tied to unfair trade practices, typically involve investigations, findings and procedural steps, and can be more vulnerable to political and diplomatic constraints. IEEPA, by contrast, has been portrayed by the administration as offering speed and flexibility, especially when linked to a declared emergency.

For businesses, the outcome is not just about refunds but about future planning. Importers and manufacturers have faced uncertainty about whether the tariffs will remain, whether they might be expanded, and how quickly trade conditions could shift. Some companies have adjusted supply chains and pricing in response to the duties, while others have waited for the courts to resolve what has become a major test of presidential power.

If the Supreme Court rules against Trump and orders or enables refunds, the mechanics of repayment could be complex. Refunds in tariff cases can require formal claims, documentation of payments, and administrative processing that can stretch over months. Trump has seized on that complexity as part of his warning, arguing the process would be costly and disruptive even if the government ultimately has enough cash to fund repayments.

The decision is also being watched internationally. Trump’s tariff approach has been a defining feature of his trade policy, used to push for revised arrangements and to demand new commitments on manufacturing and market access. A ruling that constrains those powers could alter the negotiating calculus for allies and rivals alike, particularly if it signals that broad tariff threats can be tied up in litigation.

For now, the Supreme Court’s pending ruling leaves one of the administration’s most aggressive trade strategies in legal limbo, with Trump escalating his public pressure campaign in the days leading up to a decision. His message has been stark: without the authority to deploy tariffs at will, he argues, the United States would lose leverage, lose money, and lose ground in global negotiations.